Discover 87 comprehensive and insightful ChatGPT prompts for mastering stock trading strategies. From dividend investing to cryptocurrency arbitrage, these prompts cover a wide range of topics to help you navigate the complexities of the stock market and optimize your trading approach.

Explore Our ChatGPT Prompts Library

ChatGPT Prompts for Stock Trading:

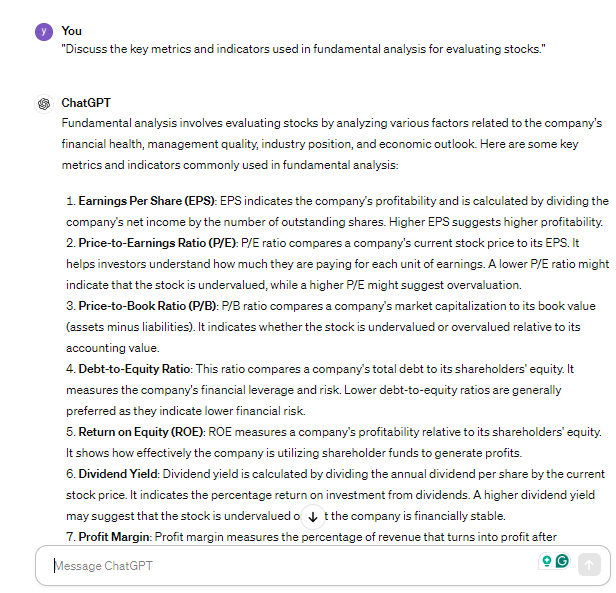

1. Fundamental Analysis Prompt: “Discuss the key metrics and indicators used in fundamental analysis for evaluating stocks.”

2. Technical Analysis Prompt: “Explain common technical analysis tools such as moving averages, MACD, RSI, and how traders use them to make trading decisions.”

3. Risk Management Prompt: “Outline different risk management strategies employed by traders to protect their capital and maximize returns.”

4. Market Sentiment Prompt: “Explore the role of market sentiment in stock trading and how traders gauge it through indicators like the put/call ratio, VIX, and sentiment surveys.”

5. Trading Strategies Prompt: “Discuss popular trading strategies such as momentum trading, value investing, swing trading, and their respective pros and cons.”

6. Market Order vs. Limit Order Prompt: “Compare and contrast market orders and limit orders, including when each type of order is most appropriate.”

7. Impact of News and Events Prompt: “Analyze how news releases, earnings reports, and macroeconomic events influence stock prices and trading behavior.”

8. Psychology of Trading Prompt: “Examine the psychological aspects of trading, including common biases such as fear of missing out (FOMO) and loss aversion, and how traders can mitigate them.”

9. Leverage and Margin Trading Prompt: “Explain the concepts of leverage and margin trading, including their potential benefits and risks for traders.”

10. Portfolio Diversification Prompt: “Discuss the importance of portfolio diversification in stock trading, including strategies for building a diversified investment portfolio.”

Visit: 99 Helpful ChatGPT Prompts For Day Trading (Day Trading Made Simple)

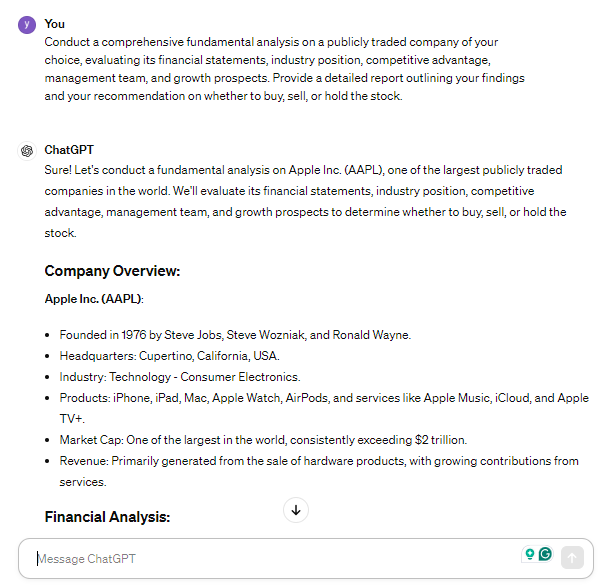

1. Fundamental Analysis Prompt: Conduct a comprehensive fundamental analysis on a publicly traded company of your choice, evaluating its financial statements, industry position, competitive advantage, management team, and growth prospects. Provide a detailed report outlining your findings and your recommendation on whether to buy, sell, or hold the stock.

2. Technical Analysis Prompt: Utilize technical analysis tools such as moving averages, MACD, RSI, and chart patterns to analyze the price action of a specific stock. Identify key support and resistance levels, trend direction, and potential entry and exit points for traders. Present your analysis with annotated charts and explain your trading strategy based on technical indicators.

3. Sector Analysis Prompt: Compare and contrast two sectors within the stock market, assessing their current performance, growth potential, and risk factors. Analyze key macroeconomic indicators, industry trends, and regulatory developments impacting each sector. Provide recommendations on which sector presents better investment opportunities and potential stock picks within each sector.

4. Risk Management Prompt: Develop a comprehensive risk management plan for a stock trading portfolio, considering factors such as position sizing, diversification, stop-loss orders, and hedging strategies. Evaluate the risk-return profile of different trading strategies and determine the optimal allocation of capital to minimize downside risk while maximizing potential returns.

5. Market Sentiment Analysis Prompt: Analyze market sentiment using sentiment indicators, option market data, and social media sentiment analysis tools. Assess the impact of investor sentiment on stock prices and market trends. Identify contrarian trading opportunities based on extreme sentiment readings and sentiment shifts in the market.

6. Event-driven Trading Prompt: Identify upcoming corporate events such as earnings announcements, product launches, mergers and acquisitions, or regulatory decisions that may impact the stock price of a specific company. Develop a trading strategy to capitalize on these events, including pre-event anticipation, event-driven trading, and post-event analysis.

7. Quantitative Trading Strategies Prompt: Design and backtest quantitative trading strategies using historical stock price data and statistical modeling techniques. Explore strategies such as mean reversion, momentum trading, pairs trading, and algorithmic trading strategies based on machine learning algorithms. Evaluate the performance of each strategy using risk-adjusted metrics and optimize trading parameters for maximum profitability.

8. Global Macro Analysis Prompt: Conduct a global macroeconomic analysis to identify macroeconomic trends and geopolitical developments that may impact the stock market. Evaluate the interplay between monetary policy, fiscal policy, interest rates, inflation, and currency exchange rates on stock prices. Develop trading strategies to capitalize on macroeconomic trends and global market correlations.

9. Options Trading Strategies Prompt: Explore advanced options trading strategies such as straddles, strangles, iron condors, and butterfly spreads. Evaluate the risk-reward profile of each strategy, including profit potential, maximum loss, and breakeven points. Develop trading plans for different market scenarios, including bullish, bearish, and neutral outlooks, using options as strategic tools for hedging and income generation.

10. Psychology of Trading Prompt: Examine the psychological aspects of trading, including cognitive biases, emotional decision-making, and herd behavior. Analyze the impact of fear, greed, overconfidence, and loss aversion on trading performance. Develop strategies to overcome psychological barriers, maintain discipline, and cultivate a resilient mindset for successful trading in volatile market conditions.

Visit: The 79 Best ChatGPT Chrome Extensions (Tried And Tested)

11. Dividend Investing Strategy Prompt: Develop a dividend investing strategy focused on identifying high-quality dividend-paying stocks with sustainable dividend yields and strong fundamentals. Evaluate criteria such as dividend payout ratio, dividend growth rate, and dividend sustainability to select potential investments. Construct a diversified portfolio of dividend stocks and analyze the impact of dividends on total return and portfolio income generation over time.

12. Value Investing vs. Growth Investing Analysis Prompt: Compare and contrast value investing and growth investing approaches to stock selection. Evaluate the key principles, investment criteria, and risk-return profiles of each strategy. Analyze historical performance and market cycles to determine the optimal strategy for different market environments. Provide recommendations on when to favor value stocks over growth stocks or vice versa based on market conditions and investment objectives.

13. Seasonality and Calendar Effects Prompt: Investigate seasonality and calendar effects in the stock market, such as the January effect, the Monday effect, and the holiday effect. Analyze historical data to identify patterns and anomalies in stock returns based on specific months, days of the week, or holiday periods. Develop trading strategies to exploit seasonality effects, including seasonal trends, market timing, and sector rotation strategies.

14. Risk Arbitrage and Special Situations Prompt: Explore risk arbitrage and special situations investing strategies, including merger arbitrage, spin-offs, restructurings, and distressed securities. Evaluate the risk-reward profile of each strategy, including deal completion probability, time horizon, and potential returns. Assess the impact of regulatory approvals, market conditions, and company-specific factors on the success of risk arbitrage trades.

15. Socially Responsible Investing (SRI) Analysis Prompt: Assess the growing trend of socially responsible investing (SRI) and environmental, social, and governance (ESG) criteria in stock selection. Evaluate the impact of ESG factors on investment performance, risk management, and corporate sustainability. Identify SRI-focused investment opportunities and analyze the financial and non-financial metrics of socially responsible companies.

16. Cyclical vs. Defensive Stocks Analysis Prompt: Analyze the distinction between cyclical and defensive stocks and their performance characteristics across different stages of the economic cycle. Evaluate the sensitivity of cyclical stocks to economic indicators such as GDP growth, interest rates, and consumer spending. Compare the defensive qualities of sectors such as healthcare, utilities, and consumer staples during economic downturns. Develop trading strategies to rotate between cyclical and defensive sectors based on macroeconomic conditions and market outlook.

17. Trend Following and Momentum Trading Prompt: Explore trend following and momentum trading strategies based on the principles of technical analysis and price momentum. Identify trending stocks using moving averages, trendlines, and momentum indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). Develop trading rules to enter and exit trades based on trend direction and momentum signals, with a focus on capitalizing on sustained price trends.

18. IPO Investing Strategy Prompt: Develop an initial public offering (IPO) investing strategy to evaluate and invest in newly listed companies. Analyze the IPO market landscape, including IPO valuation, underwriting process, and investor sentiment. Assess the investment merits and risks of participating in IPOs, including lock-up periods, insider selling, and post-IPO price performance. Develop criteria for selecting promising IPOs and timing entry and exit points for IPO investments.

19. Market Microstructure Analysis Prompt: Investigate market microstructure concepts such as order flow, market liquidity, and market efficiency. Analyze the impact of high-frequency trading (HFT) algorithms, market makers, and liquidity providers on stock price formation and market dynamics. Evaluate the role of market microstructure in price discovery, volatility, and trading strategies, including liquidity-based trading strategies and order execution tactics.

20. Tax-Efficient Investing Strategies Prompt: Design tax-efficient investing strategies to optimize portfolio returns while minimizing tax liabilities. Explore tax-efficient investment vehicles such as individual retirement accounts (IRAs), 401(k) plans, and tax-loss harvesting techniques. Analyze the tax implications of different investment types, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Develop strategies to manage capital gains, dividends, and investment income in a tax-efficient manner to maximize after-tax returns for investors.

Visit: 473 Best ChatGPT Prompts For Professionals (Boost Productivity Overnight)

21. International Diversification Strategy Prompt: Develop an international diversification strategy to enhance portfolio returns and reduce risk through exposure to global stock markets. Analyze the benefits and challenges of investing in foreign markets, including currency risk, political instability, and regulatory differences. Identify regions and countries with attractive growth prospects and undervalued equities, and construct a diversified portfolio of international stocks across developed and emerging markets.

22. Earnings Season Trading Strategy Prompt: Create a trading strategy focused on capitalizing on volatility and price movements during earnings season. Analyze historical earnings data, earnings surprises, and analyst forecasts to anticipate potential market reactions to earnings announcements. Develop trading plans for trading earnings gaps, pre-earnings momentum, and post-earnings drift based on fundamental analysis and sentiment indicators.

23. Quantitative Factor Investing Prompt: Explore quantitative factor investing strategies based on factors such as value, momentum, quality, size, and low volatility. Evaluate the empirical evidence and academic research supporting factor-based investing approaches. Design factor-based portfolios using smart beta ETFs or factor-based investment strategies, and assess the risk-adjusted returns and factor exposures of these portfolios compared to traditional market-cap-weighted indexes.

24. Short Selling Strategy Prompt: Develop a short selling strategy to profit from anticipated price declines in overvalued or deteriorating stocks. Identify overvalued stocks using fundamental analysis, valuation metrics, and technical indicators. Implement short selling techniques such as shorting individual stocks, using inverse ETFs, or trading options to profit from downward price movements. Develop risk management strategies to mitigate potential losses and manage short selling risks, including short squeezes and margin calls.

25. Event-driven Options Trading Prompt: Explore event-driven options trading strategies focused on leveraging options contracts to profit from specific corporate events or market catalysts. Identify events such as earnings announcements, FDA approvals, or M&A activity with the potential to cause significant price movements. Develop options trading strategies such as straddles, strangles, or volatility trades to capture anticipated volatility and exploit mispricings in options premiums before and after the event.

26. Robo-Advisory Portfolio Management Prompt: Evaluate the role of robo-advisors in automating portfolio management and investment decision-making processes. Analyze the features and benefits of robo-advisory platforms, including automated asset allocation, rebalancing, tax-loss harvesting, and low-cost investment options. Compare different robo-advisor platforms based on criteria such as fees, investment strategies, customization options, and user experience. Assess the suitability of robo-advisory services for different investor profiles and investment goals.

27. Market Regime Analysis Prompt: Conduct market regime analysis to identify different market environments and adjust trading strategies accordingly. Analyze factors such as market volatility, economic indicators, interest rates, and geopolitical events to classify market regimes such as bull markets, bear markets, or range-bound markets. Develop adaptive trading strategies that perform well across different market regimes, including trend-following strategies, mean-reversion strategies, and volatility-based strategies.

28. Cryptocurrency Trading Strategy Prompt: Explore cryptocurrency trading strategies for trading digital assets such as Bitcoin, Ethereum, and other altcoins. Analyze cryptocurrency market dynamics, including price volatility, liquidity, and market sentiment. Develop trading strategies for spot trading, margin trading, and derivatives trading on cryptocurrency exchanges. Evaluate the risks and opportunities of trading cryptocurrencies, including regulatory risks, security risks, and technological risks associated with blockchain technology.

29. Sustainable Investing Analysis Prompt: Assess the growing trend of sustainable investing and environmental, social, and governance (ESG) considerations in investment decision-making. Analyze the financial performance and ESG metrics of sustainable investment funds, ESG-themed ETFs, and impact investing strategies. Evaluate the integration of ESG factors into traditional investment analysis and portfolio construction techniques. Assess the impact of sustainable investing on risk management, long-term returns, and stakeholder value creation.

30. Portfolio Optimization and Asset Allocation Prompt: Optimize portfolio construction and asset allocation strategies to achieve optimal risk-adjusted returns based on investor objectives and risk tolerance. Utilize modern portfolio theory (MPT), mean-variance optimization, and capital asset pricing model (CAPM) to construct efficient frontier portfolios. Implement diversification strategies across asset classes, including stocks, bonds, real estate, and alternative investments, to reduce portfolio volatility and enhance risk-adjusted returns.

Visit: 245 Best ChatGPT Prompts For Goal Setting (Achieve More, Faster)

31. Sector Rotation Strategy Prompt: Develop a sector rotation strategy to capitalize on cyclical trends and sector rotation opportunities within the stock market. Analyze historical sector performance relative to the business cycle and macroeconomic indicators. Identify sectors poised for outperformance in different stages of the economic cycle and construct a dynamic sector rotation portfolio. Implement trading rules and criteria for rotating capital into sectors exhibiting relative strength and momentum.

32. Market Sentiment Analysis Using Alternative Data Prompt: Explore the use of alternative data sources such as social media sentiment, web traffic data, and satellite imagery for market sentiment analysis. Evaluate the predictive power of alternative data in forecasting stock prices, market trends, and investor sentiment. Develop trading strategies that incorporate alternative data signals into investment decision-making processes, including sentiment-based trading strategies and algorithmic trading models.

33. Intraday Trading Strategies Prompt: Design intraday trading strategies focused on capitalizing on short-term price movements and market volatility within the trading day. Analyze intraday price patterns, volume profiles, and liquidity dynamics to identify high-probability trading opportunities. Develop intraday trading rules and techniques such as scalping, momentum trading, and mean reversion trading strategies. Implement risk management measures to control intraday trading risks, including position sizing and stop-loss orders.

34. Machine Learning for Predictive Analytics in Trading Prompt: Explore the application of machine learning algorithms for predictive analytics in stock trading. Develop machine learning models to forecast stock prices, identify trading signals, and optimize trading strategies. Utilize supervised learning techniques such as regression, classification, and ensemble methods to train predictive models on historical market data. Evaluate the performance of machine learning models using backtesting and out-of-sample testing to assess their predictive accuracy and profitability.

35. Options Volatility Trading Strategies Prompt: Develop options volatility trading strategies focused on capitalizing on changes in implied volatility and volatility skew. Analyze options volatility surfaces and term structures to identify mispricings and trading opportunities. Implement volatility trading strategies such as volatility spreads, straddles, and strangles to profit from changes in volatility levels. Develop risk management techniques to hedge volatility exposure and manage the impact of volatility fluctuations on options positions.

36. Portfolio Stress Testing and Scenario Analysis Prompt: Conduct stress testing and scenario analysis on stock trading portfolios to evaluate their resilience to adverse market conditions and macroeconomic shocks. Identify potential sources of portfolio risk, including market risk, liquidity risk, and credit risk. Analyze the impact of extreme events such as market crashes, interest rate changes, and geopolitical crises on portfolio performance. Develop contingency plans and risk mitigation strategies to protect portfolios against downside risks and unexpected events.

37. Algorithmic Trading Strategy Development Prompt: Design algorithmic trading strategies using quantitative analysis and algorithmic execution techniques. Develop trading algorithms based on predefined rules, signals, and decision-making logic to automate trade execution processes. Utilize programming languages such as Python, R, or MATLAB to implement algorithmic trading algorithms and backtest their performance using historical market data. Optimize algorithmic trading strategies for speed, efficiency, and robustness in live trading environments.

38. Economic Indicators and Trading Strategies Prompt: Analyze the impact of key economic indicators such as GDP growth, unemployment rates, inflation, and interest rates on stock prices and market trends. Develop trading strategies that leverage economic indicators to anticipate market movements and identify trading opportunities. Evaluate leading, lagging, and coincident economic indicators and their significance for different sectors and industries. Implement trading rules based on economic data releases and economic calendar events to capture market reactions and trends.

39. Systematic Trend Following Strategies Prompt: Develop systematic trend following strategies to capture long-term price trends and momentum in the stock market. Utilize trend-following indicators such as moving averages, trendlines, and rate of change (ROC) to identify trend direction and entry/exit signals. Implement risk management techniques such as trailing stops and position sizing rules to manage trend-following positions and control downside risk. Evaluate the performance of trend-following strategies across different asset classes and market environments.

40. Cryptocurrency Arbitrage Trading Prompt: Explore cryptocurrency arbitrage trading strategies to profit from price discrepancies across different cryptocurrency exchanges. Identify arbitrage opportunities based on price differentials, trading volumes, and liquidity levels between exchanges. Develop automated trading bots or algorithms to execute arbitrage trades quickly and efficiently. Implement risk management measures to mitigate counterparty risk, exchange risk, and latency risk associated with cryptocurrency arbitrage trading strategies.

Visit: 119 Unique ChatGPT Prompts For Letter Of Recommendation (Craft Impactful Endorsements)

41. Pairs Trading Strategy Prompt: Develop a pairs trading strategy based on statistical arbitrage techniques to profit from the mean reversion of co-integrated stock pairs. Identify pairs of stocks that exhibit a high degree of correlation and historical price relationships. Implement trading rules to buy the underperforming stock in the pair while simultaneously shorting the outperforming stock when the price spread deviates from its historical mean. Backtest the pairs trading strategy using historical data to assess its profitability and risk-adjusted returns.

42. Behavioral Finance in Trading Prompt: Explore the principles of behavioral finance and cognitive biases in trading decision-making. Analyze common behavioral biases such as overconfidence, anchoring, and confirmation bias that influence trader behavior and market dynamics. Develop trading strategies that incorporate insights from behavioral finance to exploit irrational investor behavior and market inefficiencies. Implement risk management techniques to mitigate the impact of behavioral biases on trading performance and decision-making processes.

43. Market Making and Liquidity Provision Prompt: Investigate the role of market makers and liquidity providers in facilitating orderly trading and price discovery in financial markets. Analyze the mechanics of market making, including bid-ask spreads, order book dynamics, and order flow management. Develop market making strategies to profit from providing liquidity to buyers and sellers by capturing the spread between bid and ask prices. Assess the risks and rewards of market making activities, including inventory risk, adverse selection, and regulatory compliance.

44. Sector-Specific Trading Strategies Prompt: Develop sector-specific trading strategies tailored to the unique characteristics and dynamics of different industry sectors. Analyze sectoral trends, drivers, and competitive dynamics impacting industries such as technology, healthcare, financial services, and consumer discretionary. Identify sector rotation opportunities, thematic investment themes, and catalysts driving sector performance. Develop trading strategies that capitalize on sector-specific trends and events, including earnings releases, regulatory developments, and industry mergers and acquisitions.

45. Volatility Trading and Strategies Prompt: Explore volatility trading strategies designed to profit from fluctuations in market volatility and implied volatility levels. Analyze volatility indices such as the VIX (CBOE Volatility Index) and volatility derivatives such as VIX futures and options. Develop trading strategies such as volatility spreads, straddles, and volatility risk premium harvesting to capitalize on changes in volatility levels. Implement risk management techniques to hedge volatility exposure and manage the impact of volatility spikes on trading positions.

46. Statistical Arbitrage Trading Prompt: Develop statistical arbitrage trading strategies based on quantitative analysis of market inefficiencies and mispricings. Utilize statistical techniques such as cointegration, correlation analysis, and regression analysis to identify pairs or portfolios of securities with divergent price movements. Implement trading rules to buy undervalued securities and sell overvalued securities to exploit mean-reverting price relationships. Backtest the statistical arbitrage strategy using historical data to assess its profitability and risk-adjusted returns.

47. Market Impact and Execution Cost Analysis Prompt: Evaluate the impact of market liquidity, trading volume, and order execution costs on trading performance and investment returns. Analyze market impact metrics such as price impact, slippage, and market depth to assess the cost of executing trades in different market conditions. Develop execution algorithms and trading strategies that minimize transaction costs and optimize trade execution efficiency. Implement pre-trade analytics and post-trade analysis to quantify and manage execution costs across trading strategies and asset classes.

48. Regime-based Trading Strategies Prompt: Develop regime-based trading strategies that adapt to changes in market regimes and macroeconomic environments. Identify regime shifts such as bull markets, bear markets, inflationary environments, or deflationary environments based on key economic indicators and market signals. Develop trading rules and strategies tailored to each market regime, including trend-following strategies, mean-reversion strategies, and volatility-based strategies. Implement risk management techniques to adjust portfolio allocations and trading positions based on prevailing market regimes.

49. Machine Learning for Portfolio Construction Prompt: Utilize machine learning algorithms for portfolio construction and asset allocation optimization. Develop machine learning models to analyze historical market data, macroeconomic indicators, and fundamental factors to identify optimal portfolio weights and asset allocations. Implement portfolio optimization techniques such as mean-variance optimization, Black-Litterman model, and risk parity strategies using machine learning algorithms. Backtest machine learning-based portfolio strategies using historical data to assess their risk-adjusted returns and out-of-sample performance.

50. Environmental Impact Investing Analysis Prompt: Evaluate the growing trend of environmental impact investing and sustainability considerations in investment decision-making. Analyze the financial performance and environmental metrics of impact investing funds, green bonds, and ESG-themed investment products. Identify investment opportunities in sectors such as renewable energy, clean technology, and sustainable infrastructure. Assess the impact of environmental considerations on investment risk, return, and long-term value creation for investors.

Visit: 133 Best ChatGPT Prompts For Generating Business Ideas

51. Market Structure Analysis Prompt: Investigate the structure of financial markets, including exchanges, trading venues, and order types. Analyze the impact of market fragmentation, dark pools, and high-frequency trading (HFT) on market liquidity and price discovery. Evaluate regulatory initiatives such as MiFID II and Reg NMS aimed at enhancing market transparency and investor protection. Develop trading strategies that adapt to changes in market structure and leverage market microstructure dynamics for optimal trade execution.

52. Factor Timing Strategies Prompt: Explore factor timing strategies aimed at dynamically allocating capital to factor-based investment strategies based on prevailing market conditions. Identify factors such as value, momentum, size, and quality and analyze their historical performance and correlations. Develop timing indicators and signals to identify periods of factor outperformance and underperformance. Implement factor timing strategies to overweight or underweight factors in a multi-factor portfolio dynamically.

53. Long-short Equity Trading Strategies Prompt: Design long-short equity trading strategies that simultaneously go long on undervalued securities and short sell overvalued securities to exploit relative price discrepancies. Utilize fundamental analysis, quantitative modeling, and statistical techniques to identify long and short candidates. Implement risk management measures such as portfolio hedging, position sizing, and portfolio rebalancing to manage market risk and enhance risk-adjusted returns.

54. Event-driven Trading Using Alternative Data Prompt: Explore event-driven trading strategies using alternative data sources such as satellite imagery, web scraping, and sentiment analysis. Identify events such as product launches, store foot traffic, or social media sentiment shifts that can impact stock prices. Develop trading algorithms that process real-time alternative data feeds and generate actionable trading signals. Assess the predictive power and alpha potential of alternative data-driven event-driven trading strategies.

55. Market-neutral Trading Strategies Prompt: Develop market-neutral trading strategies designed to generate alpha while minimizing exposure to broad market risk factors. Utilize pairs trading, statistical arbitrage, and factor-based strategies to identify long and short positions with offsetting market beta exposures. Implement risk management techniques such as beta hedging, sector neutrality, and portfolio diversification to maintain a market-neutral risk profile. Evaluate the performance of market-neutral strategies in various market conditions and compare them to traditional long-only strategies.

56. Quantamental Investing Approach Prompt: Combine quantitative modeling techniques with fundamental analysis to develop a quantamental investing approach. Utilize machine learning algorithms and alternative data sources to enhance traditional fundamental analysis and identify investment opportunities. Integrate quantitative factors such as valuation metrics, earnings quality, and momentum signals with qualitative assessments of business fundamentals and industry dynamics. Develop a systematic process for selecting, analyzing, and managing investments using a quantamental framework.

57. Dynamic Asset Allocation Strategies Prompt: Design dynamic asset allocation strategies that adapt to changing market conditions and economic environments. Utilize macroeconomic indicators, technical analysis, and market sentiment signals to adjust portfolio allocations across asset classes. Implement tactical asset allocation strategies that overweight or underweight asset classes based on forward-looking market forecasts and risk assessments. Assess the impact of dynamic asset allocation on portfolio risk-adjusted returns and drawdown management.

58. Market Anomalies and Trading Strategies Prompt: Investigate market anomalies and inefficiencies that deviate from traditional asset pricing theories and efficient market hypotheses. Identify anomalies such as the January effect, momentum effect, and post-earnings announcement drift (PEAD). Develop trading strategies to exploit market anomalies using systematic approaches such as factor-based models, event-driven strategies, and quantitative techniques. Assess the persistence and robustness of market anomalies and their potential for generating alpha in trading strategies.

59. Factor Rotation Strategies Prompt: Explore factor rotation strategies aimed at dynamically rotating capital across factor exposures based on market regime shifts and factor performance trends. Identify factors such as value, momentum, low volatility, and quality and analyze their historical performance cycles and correlations. Develop timing indicators and signals to identify periods of factor outperformance and underperformance. Implement factor rotation strategies to adjust factor exposures dynamically and enhance risk-adjusted returns.

60. Multi-Asset Trading Strategies Prompt: Design multi-asset trading strategies that encompass stocks, bonds, currencies, commodities, and alternative investments. Analyze cross-asset correlations, macroeconomic factors, and geopolitical events that impact different asset classes. Develop trading algorithms and risk models that optimize portfolio allocations across multiple asset classes to achieve diversification and risk management objectives. Evaluate the performance of multi-asset trading strategies under different market conditions and macroeconomic scenarios.

Visit: 127 Best ChatGPT Prompts for Forex Trading

61. Portfolio Rebalancing Strategy Prompt: Develop a portfolio rebalancing strategy aimed at maintaining target asset allocations and risk profiles over time. Utilize techniques such as calendar-based rebalancing, threshold-based rebalancing, and cash flow-based rebalancing to realign portfolio weights. Implement dynamic rebalancing rules that adjust portfolio allocations in response to market fluctuations and changes in investment objectives. Evaluate the impact of portfolio rebalancing on investment returns, risk management, and transaction costs.

62. Factor Combination Strategies Prompt: Explore factor combination strategies that blend multiple factors to construct diversified investment portfolios. Identify complementary factor combinations that exhibit low correlation and enhance risk-adjusted returns. Utilize techniques such as factor tilting, factor weighting, and factor blending to combine factors such as value, momentum, quality, and low volatility. Develop factor combination portfolios using optimization techniques and factor attribution analysis to assess factor contributions to portfolio performance.

63. Leveraged and Inverse ETF Trading Strategies Prompt: Develop trading strategies using leveraged and inverse exchange-traded funds (ETFs) to amplify or hedge exposure to underlying market indices. Analyze the mechanics and performance characteristics of leveraged and inverse ETFs, including tracking error, decay, and volatility drag. Implement trading rules and risk management techniques to manage leverage and mitigate the impact of compounding effects on leveraged and inverse ETF positions. Evaluate the suitability of leveraged and inverse ETFs for different trading strategies and market conditions.

64. Alternative Data Analysis for Trading Prompt: Explore the use of alternative data sources such as satellite imagery, credit card transaction data, and geolocation data for trading and investment analysis. Identify actionable insights and predictive signals from alternative data sources to generate alpha and enhance trading strategies. Develop data processing pipelines and machine learning models to extract, clean, and analyze alternative data sets for trading purposes. Assess the information content and predictive power of alternative data in generating trading signals and investment ideas.

65. Seasonal Trading Patterns Prompt: Investigate seasonal trading patterns and calendar effects in financial markets, such as the January effect, holiday seasonality, and month-of-the-year patterns. Analyze historical data to identify recurring seasonal trends and anomalies in stock prices and trading volumes. Develop seasonal trading strategies that capitalize on seasonal patterns and anomalies using systematic approaches such as seasonality filters, calendar-based trading rules, and seasonal factor models. Evaluate the robustness and profitability of seasonal trading strategies across different time periods and market conditions.

66. Sector Rotation ETF Trading Strategies Prompt: Design sector rotation trading strategies using sector-specific exchange-traded funds (ETFs) to capitalize on sectoral trends and rotations in the stock market. Analyze sectoral performance, correlations, and macroeconomic factors driving sector rotation opportunities. Implement sector rotation algorithms that dynamically allocate capital to outperforming sectors and hedge against underperforming sectors. Evaluate the performance of sector rotation ETF trading strategies in capturing sectoral alpha and managing sectoral risk.

67. Factor Timing ETF Strategies Prompt: Develop factor timing strategies using factor-based exchange-traded funds (ETFs) to dynamically allocate capital to factors based on market conditions. Analyze factor performance cycles, macroeconomic indicators, and sentiment signals to time factor exposures. Implement factor timing algorithms that adjust factor allocations dynamically to exploit factor outperformance and underperformance trends. Assess the performance of factor timing ETF strategies in generating alpha and enhancing risk-adjusted returns.

68. Commodity Trading Strategies Prompt: Explore commodity trading strategies aimed at profiting from price movements in commodities such as gold, oil, agricultural products, and industrial metals. Analyze supply-demand dynamics, geopolitical factors, and macroeconomic indicators influencing commodity prices. Develop commodity trading algorithms that utilize technical analysis, fundamental analysis, and sentiment indicators to identify trading opportunities. Implement risk management techniques to hedge commodity price risk and manage position exposure in commodity trading strategies.

69. Machine Learning for Trade Execution Prompt: Utilize machine learning algorithms for trade execution optimization to improve trade execution quality and reduce transaction costs. Develop predictive models to estimate market impact, price slippage, and liquidity dynamics for trade execution optimization. Implement algorithmic trading strategies that dynamically adjust order routing, timing, and size based on real-time market conditions and execution signals. Evaluate the performance of machine learning-based trade execution algorithms in reducing execution costs and improving trade execution efficiency.

70. Multi-Strategy Hedge Fund Analysis Prompt: Analyze multi-strategy hedge funds that employ a combination of trading strategies across different asset classes and investment styles. Evaluate the performance attribution and risk characteristics of multi-strategy hedge fund strategies, including long/short equity, global macro, event-driven, and relative value strategies. Assess the diversification benefits and risk-adjusted returns of multi-strategy hedge funds compared to traditional asset classes and single-strategy hedge funds. Identify factors contributing to the success or underperformance of multi-strategy hedge fund strategies and their implications for investors.

Visit: 500+ Hand-Crafted Bing AI Prompts For Investors

71. Social Media Analysis for Trading Prompt: Explore the use of sentiment analysis and natural language processing (NLP) techniques to analyze social media data for trading signals. Identify influential social media platforms and channels relevant to stock market discussions and sentiment. Develop algorithms to extract actionable insights from social media posts, tweets, and online forums to gauge investor sentiment and market sentiment trends. Implement trading strategies that incorporate social media sentiment signals to guide investment decisions and capitalize on sentiment-driven market movements.

72. Market Making in Cryptocurrency Exchanges Prompt: Investigate market-making strategies in cryptocurrency exchanges aimed at providing liquidity and facilitating efficient trading. Analyze the unique characteristics and challenges of cryptocurrency markets, including high volatility, low liquidity, and fragmented trading venues. Develop algorithms and trading bots to quote bid and ask prices, manage order books, and execute trades profitably as a market maker. Implement risk management techniques to hedge market-making positions and manage exposure to cryptocurrency price fluctuations.

73. Momentum Trading with ETFs Prompt: Design momentum trading strategies using exchange-traded funds (ETFs) to capitalize on short-term price trends and momentum in various asset classes. Identify ETFs exhibiting strong relative strength and positive momentum signals based on historical price performance. Develop momentum trading algorithms that use technical indicators, such as moving averages and MACD, to identify entry and exit points for ETF trades. Implement risk management measures to control position size and manage downside risk in momentum trading strategies.

74. Cryptocurrency Arbitrage Opportunities Prompt: Explore arbitrage opportunities in cryptocurrency markets arising from price discrepancies between different exchanges and trading pairs. Analyze factors contributing to price differentials, such as exchange liquidity, order book depth, and trading volumes. Develop automated trading bots or algorithms to exploit cryptocurrency arbitrage opportunities by buying low on one exchange and selling high on another exchange. Implement risk management techniques to mitigate counterparty risk, execution risk, and exchange risk associated with cryptocurrency arbitrage trading.

75. Factor-based ETF Portfolios Prompt: Construct factor-based exchange-traded fund (ETF) portfolios that provide exposure to specific investment factors such as value, momentum, quality, and low volatility. Identify factor ETFs that track indices or baskets of stocks exhibiting desired factor characteristics. Develop portfolio allocation strategies that combine factor ETFs to achieve desired factor exposures and risk-return profiles. Implement dynamic rebalancing rules to adjust factor ETF allocations based on changing market conditions and factor performance trends.

76. Quantitative Volatility Trading Strategies Prompt: Develop quantitative volatility trading strategies aimed at profiting from fluctuations in implied volatility levels and volatility derivatives such as VIX futures and options. Analyze volatility term structure, skewness, and volatility surfaces to identify mispricings and trading opportunities. Implement volatility trading algorithms that use statistical models, machine learning techniques, or options pricing models to forecast and exploit changes in volatility levels. Evaluate the performance of quantitative volatility trading strategies under different market conditions and volatility regimes.

77. Machine Learning for Trading Signal Generation Prompt: Utilize machine learning algorithms to generate trading signals based on patterns and relationships in historical market data. Develop predictive models using supervised learning techniques such as regression, classification, and ensemble methods to forecast stock prices, identify trend reversals, or detect market anomalies. Implement trading strategies that incorporate machine learning-generated signals to guide buy/sell decisions and optimize trade entry and exit points. Evaluate the predictive accuracy and profitability of machine learning-based trading signal generation models using backtesting and out-of-sample testing.

78. ETF Rotation Strategies Prompt: Design ETF rotation strategies aimed at rotating capital across different exchange-traded funds (ETFs) to capitalize on sectoral trends, asset class rotations, or macroeconomic themes. Identify ETFs representing asset classes, sectors, or investment themes with strong relative strength and momentum signals. Develop rotation algorithms that dynamically allocate capital to ETFs exhibiting outperformance while hedging against underperforming ETFs. Implement risk management techniques to control position size and manage downside risk in ETF rotation strategies.

79. Market Impact Analysis for Large Trades Prompt: Analyze market impact and execution costs for large trades in equity markets and identify optimal execution strategies for institutional investors. Evaluate factors such as trade size, order type, liquidity, and trading venue characteristics that impact market impact and price slippage. Develop execution algorithms and trading strategies that minimize market impact and execution costs for large block trades. Implement pre-trade analysis and post-trade analysis to assess the effectiveness and efficiency of large trade execution strategies.

80. Trend Following with Futures Contracts Prompt: Develop trend-following strategies using futures contracts to capture long-term price trends and momentum in commodity, currency, and interest rate markets. Identify futures contracts exhibiting strong price trends and momentum signals based on historical price data. Develop trend-following algorithms that use technical indicators and moving averages to identify entry and exit points for futures trades. Implement risk management measures to control position size and manage downside risk in trend-following strategies using futures contracts.

Visit: 301 Tested Bing AI Prompts For Business

Final Thoughts:

Unlock the potential of stock trading with these 87 valuable prompts, designed to enhance your knowledge and elevate your trading strategies. With a wealth of information covering various aspects of stock trading, you’re equipped to make informed decisions and maximize your success in the dynamic world of finance.

Q1: Can I use ChatGPT for stock trading?

Yes, you can use ChatGPT to gather information, analyze strategies, and gain insights into various aspects of stock trading. However, it’s important to remember that ChatGPT is a language model and not a financial advisor, so it doesn’t provide personalized investment advice or predict market outcomes.

Q2: Can ChatGPT predict the stock market?

No, ChatGPT cannot predict the stock market. While it can provide information on market trends, historical data, and trading strategies, predicting the stock market with certainty is extremely challenging, even for advanced algorithms and financial experts.

Q3: How to ask ChatGPT for intraday trading?

You can ask ChatGPT about intraday trading strategies, technical analysis tools, market sentiment indicators, and risk management techniques. However, it’s important to supplement ChatGPT’s responses with your own research and analysis to make informed trading decisions.

Q4: How to make a trading strategy with ChatGPT?

You can use ChatGPT to brainstorm trading ideas, evaluate different strategies, and learn about various trading approaches such as momentum trading, swing trading, or value investing. ChatGPT can provide insights into risk management, portfolio diversification, and the psychology of trading, which are essential components of a robust trading strategy. However, remember to backtest and validate any strategy before implementing it in live trading.

Q5: Can ChatGPT predict stocks?

No, ChatGPT cannot predict specific stock prices or future market movements with certainty. It can provide information about historical stock performance, market trends, and various factors that may influence stock prices, but it cannot predict individual stock movements.

Q6: Can ChatGPT pick stocks?

ChatGPT can provide information and insights that may aid in stock selection, such as fundamental analysis metrics, technical indicators, and market sentiment analysis. However, it’s important to conduct thorough research and analysis before making investment decisions.

Q7: Can ChatGPT analyze stocks?

Yes, ChatGPT can analyze stocks by providing information on company fundamentals, historical stock performance, technical analysis tools, and market trends. It can also discuss various factors that may impact stock prices, such as earnings reports, industry trends, and macroeconomic conditions.

Q8: Can I buy stock in ChatGPT?

No, ChatGPT is a language model developed by OpenAI and is not a publicly traded company. Therefore, you cannot buy stock in ChatGPT.

Q9: Can ChatGPT help me invest?

ChatGPT can provide information, insights, and guidance on various aspects of investing, including stock selection, portfolio diversification, risk management, and investment strategies. However, it’s essential to supplement ChatGPT’s responses with your own research and analysis and consult with a qualified financial advisor before making investment decisions.

Q10: Can ChatGPT 4 trade?

ChatGPT itself cannot execute trades or perform transactions in the stock market. It can provide information and insights to help inform trading decisions, but actual trading activities must be conducted through a brokerage platform or other trading services.

For More Information, About Author Visit Our Team