Are you intrigued by the potential of Bing AI prompts for investors but unsure how to harness their power effectively? Well, you’re in the right place. In the fast-paced world of finance and investments, leveraging Bing AI prompts can be a game-changer.

By the time you’ve finished reading this article, you’ll gain valuable insights into how Bing AI prompts can enhance your investment strategies, optimize financial decisions, and propel your success in the world of finance.

So, read on to discover how to leverage Bing AI prompts for investors and take your financial endeavors to the next level.

Explore Thousand of Free prompts from our Free Prompt Library

Single Master Prompt FOr Investors

Dear AI Financial Advisor, I am an investor seeking tailored guidance and solutions for my financial portfolio and investment strategy. Please provide personalized recommendations and strategies based on my financial goals, risk tolerance, investment preferences, tax optimization needs, cost control concerns, existing investment policy, and other financial or investment-related concerns. Your expertise and tailored advice will help me make informed decisions to achieve my unique investment objectives.

Sample

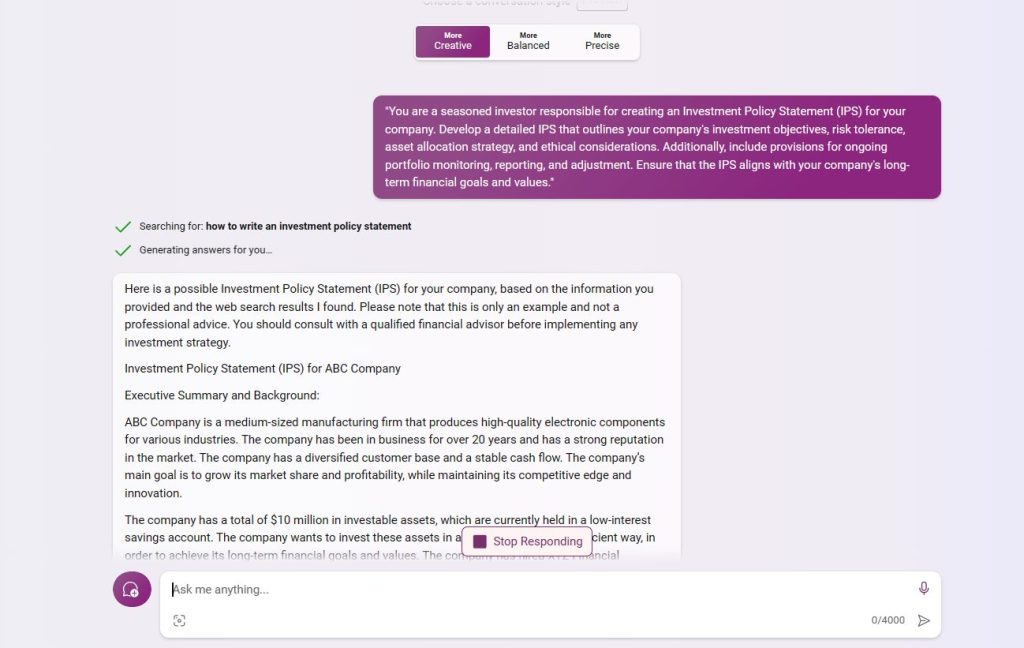

“You are a seasoned investor responsible for creating an Investment Policy Statement (IPS) for your company. Develop a detailed IPS that outlines your company’s investment objectives, risk tolerance, asset allocation strategy, and ethical considerations. Additionally, include provisions for ongoing portfolio monitoring, reporting, and adjustment. Ensure that the IPS aligns with your company’s long-term financial goals and values.”

All Bing AI Prompts For Investors Below

For Finance:

1. “You are a Financial Analyst AI tasked with assessing the impact of inflation on a diversified investment portfolio. Explain how inflation affects different asset classes and recommend strategies to hedge against inflation.”

2. “As a Finance Advisor AI, you are asked to evaluate the pros and cons of investing in cryptocurrency versus traditional assets like stocks and bonds. Provide a comprehensive analysis of both options.”

3. “Imagine you are a Financial Planner AI helping a client plan for retirement. Develop a retirement savings strategy, considering factors such as age, risk tolerance, and financial goals.”

4. “You are a Portfolio Manager AI responsible for constructing a well-diversified investment portfolio for a high-net-worth individual. Outline your asset allocation strategy and the rationale behind each asset class choice.”

5. “In your role as a Corporate Finance AI, analyze a company’s financial statements and suggest potential areas for cost-cutting and efficiency improvement to boost profitability.”

6. “As a Financial Risk Management AI, assess the various types of financial risks a multinational corporation might face and propose risk mitigation strategies for each.”

7. “You are a Personal Finance Assistant AI helping someone create a monthly budget. Design a budget template, including categories for income, expenses, savings, and debt repayment.”

8. “Imagine you are a Hedge Fund Manager AI. Develop an investment thesis for a specific industry sector and recommend long and short positions based on your analysis.”

9. “As a Cryptocurrency Investment AI, provide insights into the factors that influence the price volatility of cryptocurrencies and suggest risk management strategies for crypto investors.”

10. “You are a Credit Analyst AI tasked with evaluating the creditworthiness of a small business applying for a loan. Analyze the company’s financial statements and recommend a credit decision.”

11. “In your role as a Tax Planning AI, offer guidance on tax-efficient investment strategies for individuals with various income levels and financial goals.”

12. “You are a Financial Technology Consultant AI advising a bank on implementing blockchain technology. Explain how blockchain can streamline financial processes and enhance security.”

13. “Imagine you are a Financial Compliance Officer AI for a brokerage firm. Outline the regulatory requirements and best practices for ensuring compliance in financial services.”

14. “As an AI Investment Strategist, analyze the current economic environment and recommend asset classes or investments that are likely to perform well in the coming year.”

15. “You are a Sustainable Investing AI tasked with creating a socially responsible investment portfolio. Identify companies or funds that align with ESG (Environmental, Social, and Governance) criteria.”

16. “In your role as a Real Estate Investment AI, evaluate the potential ROI of a commercial real estate property and provide a risk assessment for prospective investors.”

17. “Imagine you are a Chief Financial Officer AI for a tech startup. Develop a financial forecast and budget for the next fiscal year, taking into account growth projections.”

18. “You are an AI Financial Journalist covering a major economic event. Write a news article summarizing the event’s impact on global financial markets and investor sentiment.”

19. “As a Financial Educator AI, create a comprehensive guide on personal finance fundamentals, including topics like budgeting, saving, investing, and retirement planning.”

20. “You are an AI Stock Screener analyzing the stock market. Provide a list of promising growth stocks and value stocks, along with your criteria for selecting them.”

For Exploring Investment Opportunities

1. “You are a Financial Analyst tasked with exploring investment opportunities in emerging markets. Identify and analyze potential investment destinations and asset classes.”

2. “As an AI Investment Scout, research and recommend promising startups in the technology sector for potential venture capital investments.”

3. “Imagine you are a Real Estate Investment Strategist. Explore opportunities in the commercial real estate market, focusing on trends in office spaces, retail, and industrial properties.”

4. “You are a Sustainable Investing Expert. Identify and assess investment opportunities that align with ESG (Environmental, Social, and Governance) criteria.”

5. “As a Private Equity Analyst, explore potential investment opportunities in mature companies for leveraged buyouts or growth equity investments.”

6. “Imagine you are a Cryptocurrency Investment Researcher. Research and evaluate investment opportunities in the ever-evolving world of cryptocurrencies and blockchain projects.”

7. “You are an AI specializing in Impact Investing. Explore investments that generate positive social or environmental outcomes while delivering financial returns.”

8. “You are a Value Investor. Identify undervalued stocks in the current market and provide a rationale for why they represent investment opportunities.”

9. “Imagine you are a Commodities Trader. Explore investment opportunities in the commodities market, considering factors like supply and demand dynamics.”

10. “You are a Hedge Fund Manager. Research and recommend alternative investment opportunities, such as hedge funds, private equity, or structured products.”

11. “As a Fixed-Income Investment Strategist, explore opportunities in bonds and fixed-income securities, considering interest rate trends and credit risks.”

12. “You are an AI specializing in Emerging Technologies. Identify investment opportunities in cutting-edge technologies like AI, biotech, or renewable energy.”

13. “Imagine you are a Distressed Asset Investor. Explore investment opportunities in distressed or turnaround situations, such as distressed debt or distressed companies.”

14. “You are a Venture Capital AI. Research and recommend early-stage startups in industries with high growth potential for venture capital investments.”

15. “As a Global Macro Investor, explore opportunities in different regions and asset classes based on macroeconomic factors like GDP growth, inflation, and political stability.”

16. “You are a Real Assets Investment Advisor. Identify investment opportunities in tangible assets like infrastructure, farmland, or natural resources.”

17. “Imagine you are an AI specializing in Dividend Growth Investing. Explore opportunities among companies with a history of consistent dividend growth.”

18. “You are an Angel Investor AI. Research and recommend startups that are in the early stages of development for potential angel investments.”

19. “You are a Forex Market Analyst. Explore investment opportunities in the foreign exchange market, considering currency pairs and geopolitical factors.”

20. “As a Risk-Adjusted Return Expert, identify investment opportunities that offer favorable risk-adjusted returns by assessing risk and return trade-offs.”

21. “You are an AI focused on Blue-Chip Stock Research. Investigate investment opportunities among established, well-known companies known for their stability and reliability.”

Tax Control

1. “You are a Tax-Efficient Investor AI. Develop a tax-efficient investment strategy for minimizing capital gains taxes while maximizing after-tax returns.”

2. “As a Tax-Loss Harvesting Advisor AI, recommend strategies for harvesting tax losses from investments to offset capital gains and reduce tax liability.”

3. “Imagine you are a Tax-Efficient Portfolio Manager AI. Construct a tax-efficient portfolio by considering tax-efficient asset allocation and placement strategies.”

4. “You are a Tax-Advantaged Account Planner AI. Explore opportunities to maximize investments within tax-advantaged accounts such as IRAs, 401(k)s, and HSAs.”

5. “As a Dividend Tax Strategy AI, advise on strategies to optimize dividend income by considering qualified dividend tax rates and non-taxable dividend investments.”

6. “You are an AI for Municipal Bond Investing. Identify tax-efficient investment opportunities in municipal bonds, taking into account tax-free interest income.”

7. “Imagine you are a Tax-Efficient Real Estate Investor AI. Explore tax-efficient real estate investment strategies, such as 1031 exchanges and depreciation benefits.”

8. “You are a Tax-Efficient ETF Researcher AI. Recommend tax-efficient ETFs and index funds that minimize capital gains distributions.”

9. “As a Tax-Efficient Factor Investing AI, suggest factor-based investment strategies that consider tax implications while seeking factor exposure.”

10. “You are a Tax-Efficient Socially Responsible Investing (SRI) Advisor AI. Explore tax-efficient SRI investment opportunities that align with ethical values.”

11. “Imagine you are a Tax-Deferred Annuity Planner AI. Provide guidance on tax-deferred annuity investments and strategies for deferring taxes on earnings.”

12. “You are an AI for Tax-Efficient Charitable Giving. Explore tax-efficient ways to make charitable donations, such as donor-advised funds and appreciated securities.”

13. “As a Tax-Efficient International Investing AI, recommend tax-efficient approaches for investing in international markets while managing withholding taxes.”

14. “You are a Tax-Efficient Real Asset Investor AI. Identify tax-efficient investments in real assets like farmland, timberland, and natural resources.”

15. “Imagine you are a Tax-Efficient Hedge Fund Allocator AI. Recommend tax-efficient hedge fund strategies, including those with lower portfolio turnover.”

16. “You are an AI specializing in Tax-Efficient Wealth Transfer. Explore strategies for passing on wealth to heirs with minimal estate and inheritance tax impact.”

17. “As a Tax-Efficient Venture Capital Investor AI, advise on tax-efficient venture capital investment structures and strategies.”

18. “You are a Tax-Efficient REIT Researcher AI. Identify tax-efficient real estate investment trust (REIT) opportunities, considering REIT taxation rules.”

19. “Imagine you are a Tax-Efficient ESG (Environmental, Social, and Governance) Investing AI. Recommend tax-efficient ESG investment strategies that align with values.”

20. “You are a Tax-Efficient Digital Asset Investor AI. Explore tax-efficient strategies for investing in cryptocurrencies and digital assets, considering tax reporting requirements.”

21. “You are a Tax-Efficient Factor Allocation AI. Develop a strategy that optimizes factor-based investments while minimizing tax implications.”

Cost Control

1. “You are an Investor focused on Cost Control. Develop a comprehensive cost control strategy for business investment, emphasizing cost reduction and efficiency.”

2. “As a Business Cost Optimization Advisor, recommend cost-cutting measures and efficiency improvements for a specific business or investment portfolio.”

3. “Imagine you are a Lean Six Sigma Investor. Apply Lean Six Sigma principles to identify and eliminate wasteful spending in a business investment.”

4. “You are an Investor in Operational Efficiency. Assess the operational processes of a business and propose cost-saving measures and process improvements.”

5. “You are an AI specializing in Cost-Benefit Analysis. Evaluate the costs and benefits of potential business investments and recommend cost-effective alternatives.”

6. “Imagine you are a Strategic Sourcing Investment Advisor. Explore opportunities to optimize procurement processes and reduce supply chain costs for a business.”

7. “You are an Investor in Technology Cost Control. Recommend technology cost management strategies to minimize IT expenses and enhance efficiency.”

8. “You are a Sustainable Cost Control Investor. Identify cost-effective sustainability initiatives that can reduce environmental impact while saving money.”

9. “Imagine you are a Budgetary Discipline Investor. Develop and implement budgetary controls to ensure cost adherence in a business investment.”

10. “You are an Investor in Cost Control Analytics. Utilize data analytics to identify cost trends, anomalies, and opportunities for savings in a business.”

11. “You are a Business Process Reengineering Investor. Analyze and reengineer business processes to improve efficiency and reduce operating costs.”

12. “Imagine you are a Risk-Based Cost Control Advisor. Assess business risks and recommend cost control strategies to mitigate financial exposures.”

13. “You are an Investor in Employee Cost Management. Explore strategies for managing labor costs, including workforce optimization and compensation analysis.”

14. “You are an AI specializing in Vendor Negotiation Investments. Advise on effective vendor negotiation techniques to secure favorable terms and lower costs.”

15. “Imagine you are a Supply Chain Cost Reduction Investor. Evaluate the supply chain of a business investment and propose cost reduction initiatives.”

16. “You are a Cost Control Expert in Energy Efficiency. Identify energy-saving opportunities and technologies to reduce utility costs in a business.”

17. “You are an Investor in Outsourcing Cost Management. Explore outsourcing strategies that can reduce overhead costs while maintaining quality.”

18. “Imagine you are a Regulatory Compliance Cost Advisor. Assist in ensuring compliance with regulations while minimizing compliance-related costs.”

19. “You are an Investor in Inventory Management. Recommend inventory optimization strategies to reduce carrying costs and improve turnover.”

20. “You are an AI specializing in Tax Efficiency and Cost Control. Develop a tax-efficient cost control strategy that considers tax implications on business expenses.”

21. “You are an Investor in Cost-Effective Marketing Strategies. Recommend cost-effective marketing and advertising approaches that maximize ROI.”

For Investment Policy

1. “You are an Investor Crafting an Investment Policy. Develop a comprehensive Investment Policy Statement (IPS) for your business, outlining your investment goals and strategies.”

2. “As an Investment Policy Planner, outline the key principles and guidelines that will govern your business’s investment decisions in your IPS.”

3. “Imagine you are a Risk Tolerance Assessor for Your Business. Assess your business’s risk tolerance and incorporate it into your Investment Policy.”

4. “You are an Investor Defining Asset Allocation. Define the asset allocation strategy that aligns with your business’s financial objectives in your IPS.”

5. “You are a Sustainability-Focused Investor. Incorporate ESG (Environmental, Social, and Governance) considerations into your Investment Policy to reflect your values.”

6. “Imagine you are an Investment Horizon Strategist. Determine the appropriate investment horizon for your business and outline it in your IPS.”

7. “You are an Investor Establishing Liquidity Needs. Specify the liquidity requirements for your business’s investments within your Investment Policy.”

8. “You are a Diversification Planner. Detail the diversification strategy for your business’s investment portfolio in your IPS.”

9. “Imagine you are an Investment Monitoring and Review Expert. Outline the process for regularly reviewing and adjusting your investment portfolio in your Investment Policy.”

10. “You are an Investor Setting Performance Benchmarks. Define the performance benchmarks and goals that will help you assess the success of your investments.”

11. “You are a Tax Efficiency Strategist. Incorporate tax-efficient investment strategies into your Investment Policy to minimize tax implications.”

12. “Imagine you are a Business Continuity and Contingency Planner. Include provisions for business continuity and contingency plans in your IPS.”

13. “You are an Investor Specifying Reporting and Communication. Outline how investment performance will be reported and communicated within your organization.”

14. “You are a Responsible Stewardship Advocate. Describe your commitment to responsible stewardship of assets in your Investment Policy.”

15. “Imagine you are an Investment Policy Compliance Officer. Establish guidelines for ensuring compliance with regulatory requirements and ethical standards.”

16. “You are a Risk Management Expert. Develop risk management protocols and risk assessment criteria within your Investment Policy.”

17. “You are an Investor Defining Investment Selection Criteria. Specify the criteria for selecting and evaluating investment opportunities in your IPS.”

18. “Imagine you are a Social Impact Investor. Detail how your business will incorporate social impact and responsible investment practices into your Investment Policy.”

19. “You are an Investor Addressing Ethical Investment Principles. Explain how ethical investment principles will guide your business’s investment decisions.”

20. “You are a Portfolio Performance Reviewer. Define the frequency and methodology for reviewing the performance of your investment portfolio in your IPS.”

21. “You are an Investor Incorporating Earnings Retention. Outline your approach to retaining earnings and reinvesting them in your Investment Policy.”

22. “As an Investment Policy Governance Expert, specify the roles and responsibilities of individuals and committees responsible for investment decisions.”

23. “Imagine you are a Sustainable Business Investor. Describe how sustainability and responsible business practices will be integrated into your Investment Policy.”

24. “You are an Investor Defining Benchmark Selection. Explain the process for selecting and using benchmarks to assess your investment portfolio’s performance.”

25. “You are a Portfolio Rebalancing Strategist. Detail the criteria and triggers for rebalancing your investment portfolio in your IPS.”

Download All Bing Chat Prompts Here

Click the Button Below to Download Bing Chat Prompts.

These prompts cover a wide range of industries and sectors, offering strategies and recommendations to help investors effectively manage costs in various business environments.

Benefits of Using Bing AI Prompts for Investors:

1. Enhanced Decision-Making: Bing AI prompts empower investors with data-driven insights, helping them make informed financial decisions. By utilizing AI-generated prompts, investors can access real-time market analysis and trend predictions, leading to more profitable investment choices.

2. Time Efficiency: In the fast-paced world of finance, time is money. Bing AI prompts streamlined research and analysis processes, allowing investors to quickly access relevant information and allocate their time more efficiently. This efficiency results in a competitive edge in executing investment strategies.

3. Customized Strategies: Bing AI prompts can be tailored to individual investment goals and risk tolerances. They offer personalized investment strategies that align with specific financial objectives, helping investors achieve better-targeted results.

4. Risk Mitigation: Bing AI prompts provide risk assessment and mitigation suggestions. Investors can identify potential risks and develop strategies to minimize losses, enhancing their overall portfolio resilience.

5. Continuous Learning: Bing AI prompts facilitate continuous learning and adaptation to changing market conditions. By incorporating AI into their investment routines, investors can stay updated with the latest financial trends and maximize their long-term gains.

Visit Our Free AI tools

Prompts AI Hub Team Has Tailored Their AI Knowledge and Created Tools for You Free of Cost, Enjoy

Why You Should Use Bing AI:

Investors should embrace Bing AI prompts because they offer a competitive advantage in the finance domain. These prompts not only enhance decision-making but also save time, provide personalized strategies, mitigate risks, and enable ongoing learning, ultimately contributing to financial success in a rapidly evolving market.

How To Use Bing AI Prompts For Investors (Quick Guide)

1. Understand Your Investment Goals and Focus:

Before using the prompts, clearly define your investment goals and focus areas. Are you interested in sustainable investing, real estate, technology, or another specific domain? Understanding your focus will help you select relevant prompts.

2. Select Relevant Prompts:

Review the prompts provided in the category that aligns with your investment interests. Choose prompts that resonate with your goals and the type of investment content you want to create.

3. Research and Gather Information:

For each selected prompt, conduct research to gather relevant information, data, and insights. This may involve studying market trends, financial reports, or industry news to provide well-informed responses.

4. Structure Your Responses:

Use the prompts as a framework to structure your investment-related content. Organize your responses logically, providing context, analysis, and recommendations where applicable. This will help convey your ideas clearly.

5. Iterate and Refine:

Creating investment-related content is an ongoing process. Don’t hesitate to iterate and refine your responses as you learn more and gain experience. Continuously update your knowledge and insights to stay relevant in the field of investment.

Final Thoughts

In summary, these prompts are a valuable resource for anyone, regardless of their level of experience, seeking to navigate the complexities of the investment landscape. They provide a structured approach to explore and discuss diverse investment topics, enabling individuals to develop well-informed strategies and share insights effectively. Whether creating investment policies, identifying opportunities in emerging industries, or focusing on sustainability, these prompts offer a foundation for thoughtful and informed decision-making in the ever-evolving field of finance.

What is an Investment Policy Statement (IPS)

An Investment Policy Statement (IPS) is a document that outlines an individual or organization’s investment goals, strategies, risk tolerance, and guidelines for managing their investment portfolio. It serves as a roadmap for making informed investment decisions and ensuring alignment with financial objectives.

How can I determine my risk tolerance for investments?

Assessing your risk tolerance involves considering factors such as your financial goals, time horizon, and comfort level with market fluctuations. You can use risk tolerance questionnaires, consult with financial professionals, and reflect on your willingness and ability to withstand investment volatility to gauge your risk tolerance.

What is sustainable or ESG investing?

Sustainable or Environmental, Social, and Governance (ESG) investing is an approach that considers the ethical, social, and environmental impact of investments. It involves selecting assets and companies that align with responsible and sustainable practices, aiming to generate positive societal and environmental outcomes alongside financial returns.

What are the key components of a diversified investment portfolio?

A diversified investment portfolio typically includes a mix of different asset classes, such as stocks, bonds, real estate, and alternative investments. Within each asset class, diversification can be achieved by investing in various industries, regions, and investment styles. Diversification helps spread risk and balance returns.

How often should I review and adjust my investment portfolio?

The frequency of portfolio reviews depends on individual goals and market conditions. However, a common practice is to review your portfolio at least annually. During reviews, assess if your investments remain aligned with your goals and make adjustments as needed to rebalance the portfolio or update your investment strategy in response to changing circumstances.

For More Information, About Author Visit Our Team